LET US TACKLE THE TASK OF FILING YOUR HEARING BENEFITS

STEP 1

PROVIDE YOUR

INSURANCE POLICY INFO

Make your appointment for a hearing evaluation at Johnson Audiology. Call one of our friendly patient care coordinators or fill out the form below. Include your insurance policy info. In prep for your appointment, a Johnson Audiology insurance specialist will contact your insurance company to verify

your benefits.

STEP 2

LET’S TEST YOUR

HEARING

After a warm welcome by our patient care coordinators, your audiologist will conduct your hearing evaluation. Your hearing will be tested in our spacious and comfortable, state-of-the-art sound-proof testing booth.

STEP 3

FILING YOUR INSURANCE

BENEFITS FOR YOU

Next, your audiologist will go over the results of your hearing test with you, make recommendations for treating your hearing loss, and review any benefits your health insurance policy offers for hearing aids. Then you can make your most informed decision about next steps. After your appointment, leave it to us. If your insurance company if one we contract with, our in-house insurance specialists will file your insurance benefits for you.

SAY HELLO TO YOUR TEAM OF INSURANCE SPECIALISTS

Our in-house insurance experts—Chelsea, Cindy and Mandie—have years of experience in hearing health care and are here to help you navigate the often-confusing world of insurance verification and filing. They are another important part of the team working tirelessly to help you hear better!

CHELSEA

INSURANCE SPECIALIST

“ I am so proud to work for a practice that puts a priority on patient care and offering patients options for getting the very best hearing aid technology.

“

CINDY

PRACTICE MANAGER

“ Some insurance policies can be confusing for patients. I love finding ways to explain it to a patient so they have a clear understanding of

their benefits.

“

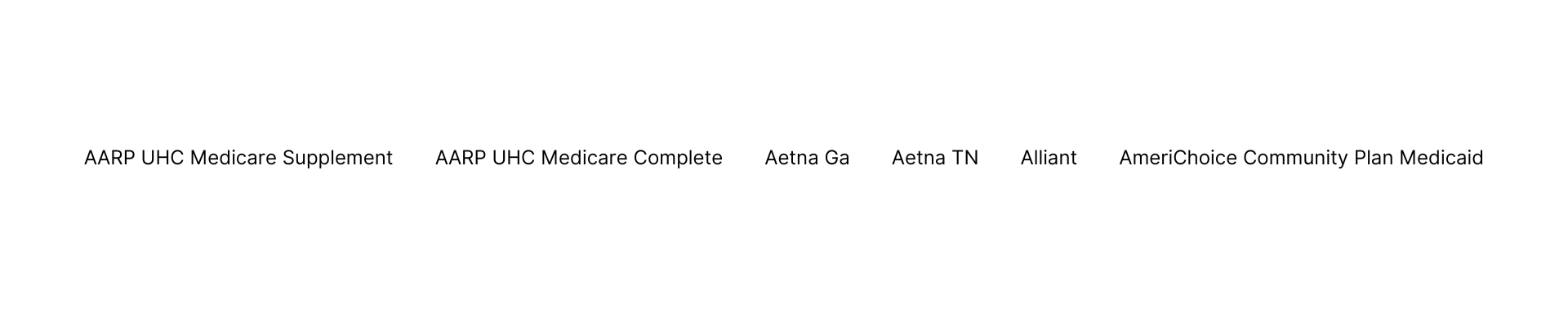

WORKING WITH MORE THAN 85 MAJOR INSURANCE COMPANIES AND HEARING AID BENEFIT PROGRAMS TO SERVE YOU BETTER

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

AARP UHC Medicare Supplement

AARP UHC Medicare Complete

Aetna TN

Aetna GA

Alliant

AmeriChoice Community Plan Medicaid

AmeriGroup Medicaid

AmeriGroup Medicare

Ambetter

Amplifon

Bright

BCBS Federal Network R Basic or Standard

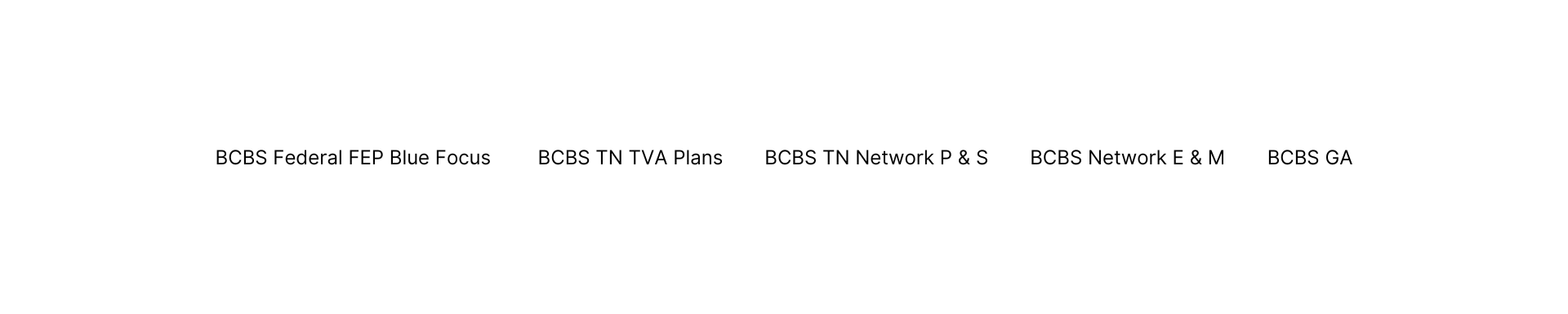

BCBS Federal FEP Blue Focus

BCBS TN TVA Plans

BCBS TN Network P & S

BCBS TN Network E & M

BCBS GA

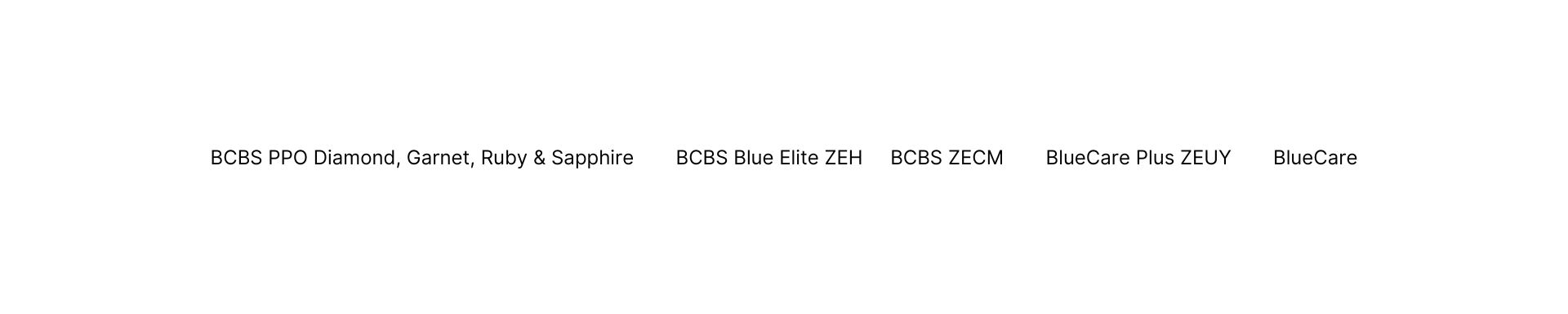

BCBS PPO Diamond, Garnet, Ruby & Sapphire ZXD & ZXDY

BCBS Blue Elite ZEH

BCBS ZECM

BlueCare Plus ZEUY

BlueCare

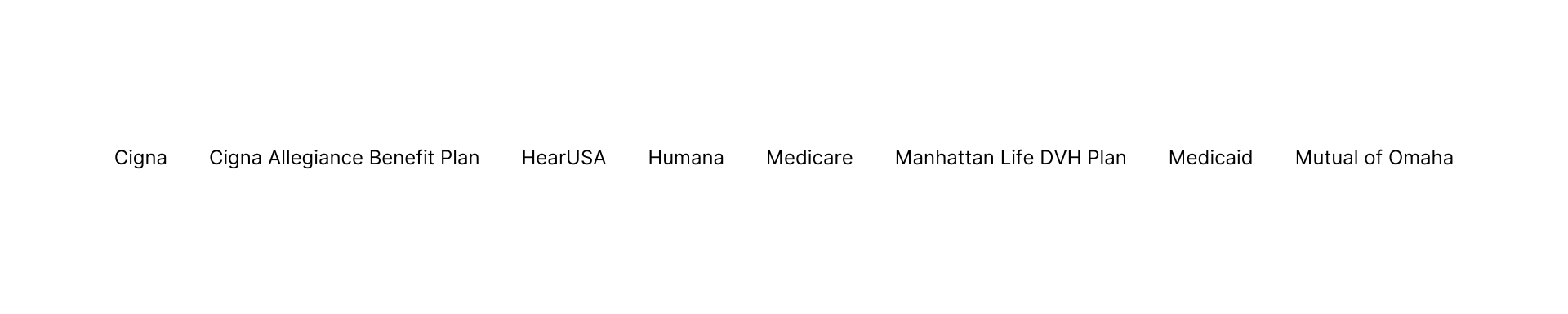

Cigna

Cigna Allegiance Benefit Plan

Cigna Healthspring

HearUSA

Hearing Care Solutions

Humana

Medicare

Manhattan Life DVH Plan

Medicaid

Mutual of Omaha

QMB State of TN

TriCare East/Humana Military Active Duty

TruHearing

UHC Commercial

UHC Community Plan Medicaid

UHC Community Plan Medicare Dual Complete

UHC River Valley (not Medicaid)

TennCare

AARP UHC Medicare Supplement

AARP UHC Medicare Complete

Aetna TN

Aetna GA

Alliant

AmeriChoice Community Plan Medicaid

AmeriGroup Medicaid

AmeriGroup Medicare

Ambetter

Amplifon

Bright

BCBS Federal Network R Basic or Standard

BCBS Federal FEP Blue Focus

BCBS TN TVA Plans

BCBS TN Network P & S

BCBS TN Network E & M

BCBS GA

BCBS PPO Diamond, Garnet, Ruby & Sapphire ZXD & ZXDY

BCBS Blue Elite ZEH

BCBS ZECM

BlueCare Plus ZEUY

BlueCare

Cigna

Cigna Allegiance Benefit Plan

Cigna Healthspring

HearUSA

Hearing Care Solutions

Humana

Medicare

Manhattan Life DVH Plan

Medicaid

Mutual of Omaha

QMB State of TN

TriCare East/Humana Military Active Duty

TruHearing

UHC Commercial

UHC Community Plan Medicaid

UHC Community Plan Medicare Dual Complete

UHC River Valley (not Medicaid)

TennCare

Schedule Your Appointment, and We’ll Check Your Benefits

We will get back to you as soon as possible.

Please try again later.

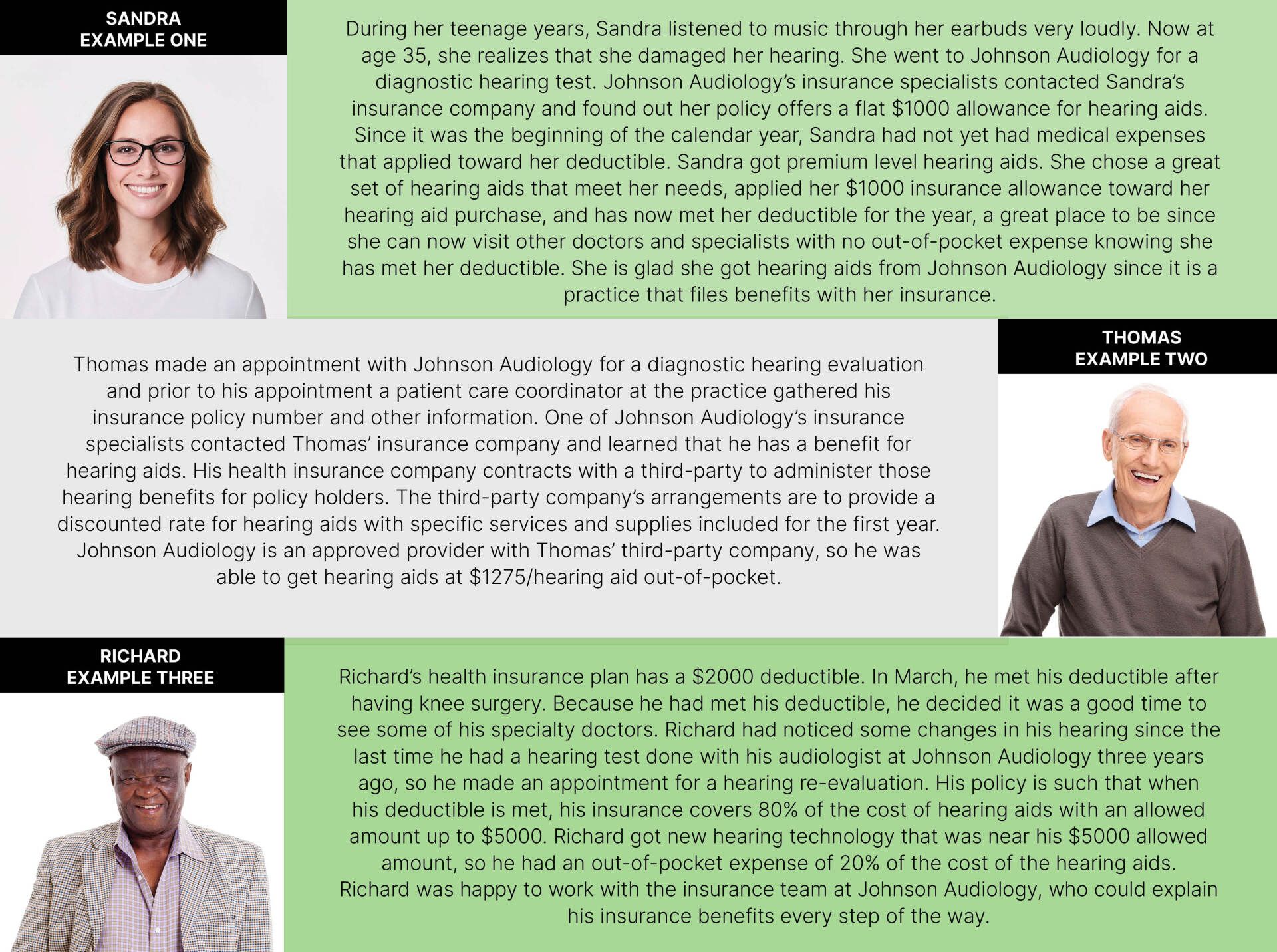

THREE EXAMPLES OF COVERAGE

Each person’s insurance policy is different. Many plans these days have benefits for hearing health care built in, so it is always worth checking to find out. If the answer is Yes, the next step is to determine the specific benefits that are part of your plan, how they are administered and if Johnson Audiology is an approved provider with the company. Here are three examples of how your insurance may cover your hearing health care.

RECOGNIZE MISLEADING LANGUAGE

Be aware! Some hearing aid dispensers, including well-known franchise stores and online hearing aid companies, will use deliberately obscure language to make it sound like the company is filing a claim with your insurance when they are not. If a claim is not filed, then your transaction is not linked in any way with your deductible and/or maximum out of pocket. Below are some examples of

doublespeak to look out for.

WHAT DOES THE PHRASE

"WE HONOR YOUR PLAN & PROVIDER"

REALLY MEAN?

Some local franchise stores and online or mail order hearing aid dispensers use misleading phrases when it comes to the question of whether they file with your insurance. If you ask, “Do you take insurance?”, the response will be something like: “We honor various plans and providers.” Be aware that the word “honor” does not mean the same thing as the word “file.” Most do not work with insurance but will instead tell you that they are giving you their special discount plan for XYZ Insurance Company. What this means is they are not actually filing with your insurance; thus, your purchase with them does not factor into your insurance deductible.

WHAT DOES THE PHRASE

"WE ARE OUT-OF-NETWORK WITH YOUR INSURANCE" REALLY MEAN?

Some franchise stores and online or mail order hearing aid dispensers will say that they are “out-of-network” when you ask if they take your insurance. Many of these companies do not meet the criteria as a type of provider who can legally contract with your insurance in the first place, so for them to say that they are out-of-network is a misnomer.

WHAT DOES THE PHRASE

"WE WILL MAXIMIZE YOUR MEDICARE PLAN HEARING BENEFIT"

REALLY MEAN?

Private practices like Johnson Audiology meet the criteria of a type of health care provider that can legally contract with insurance companies. Practices make a significant commitment in time and expense in order to work with insurance companies so that patients get full use of the insurance benefits they have invested in. For instance, to be a practice that files with Medicare on behalf of a patient, Medicare has a caveat that the practice cannot do hearing testing free of charge. Therefore, if you visit a hearing aid dispenser that offers free hearing tests, that is a sure sign they do not contract with Medicare. Yet that same dispenser will use language that says “they will maximize your Medicare plan's hearing benefit.” This phrasing is doublespeak that makes patients think their claim is being filed to Medicare.

*This link leads to the machine-readable files that are made available in response to the federal Transparency in Coverage Rule and includes negotiated service rates and out-of-network allowed amounts between health plans and healthcare providers. The machine readable files are formatted to allow researchers, regulators, and application developers to more easily access and analyze data.

All Rights Reserved | Johnson Audiology | Powered by Flypaper | Privacy Policy